Saving money is an essential aspect of personal finance, but it can often feel overwhelming and confusing. Like most success stories though, having a plan to follow will keep you moving along the right path.

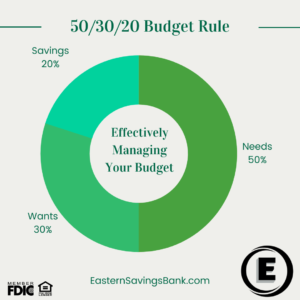

One savings plan that is recommended is the 50/30/20 rule. This rule of budgeting provides a straightforward framework to manage your finances effectively. It encourages you to allocate your income into three distinct categories: needs, wants, and savings.

In this article, we will delve into the 50/30/20 rule and explore strategies to tackle each component successfully.

Understanding the 50/30/20 Rule

The 50/30/20 rule is a simple guideline that helps you allocate your income based on percentages. According to this rule, you should allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings.

A) Needs (50%)

“Needs” encompass essential expenses required for your basic survival and well-being. These may include rent/mortgage, utilities, groceries, transportation, healthcare, and minimum debt payments. To tackle this component effectively:

- Create a detailed budget: List all your necessary expenses, track your spending, and ensure your needs fit within the 50% allocation.

- Minimize costs: Look for opportunities to reduce expenses. Consider downsizing your living arrangements, carpooling, or exploring more affordable healthcare options.

- Prioritize debt repayment: Allocate a portion of the 50% towards paying off debts, starting with high-interest obligations.

B) Wants (30%)

“Wants” refer to discretionary expenses that enhance your lifestyle but are not essential for survival. This category includes entertainment, dining out, vacations, hobbies, and non-essential shopping. To manage wants effectively:

- Set spending limits: Determine a monthly spending limit for each want category to ensure you stay within the 30% allocation.

- Differentiate between needs and wants: Be mindful of your spending habits and distinguish between necessary expenses and non-essential or luxury purchases.

- Find cost-effective alternatives: Explore affordable ways to enjoy your wants. Look for free or low-cost activities, use coupons, or seek out budget-friendly travel options.

- Prioritize: Although you have many options on how to spend your money, make sure you are spending on things that matter to you or add value to your life.

C) Savings (20%)

The “savings” component is crucial for building financial security and planning for the future. This category includes emergency funds, retirement savings, investments, and long-term financial goals. To make the most of your savings:

- Automate your savings: Set up automatic transfers from your paycheck to your savings account to ensure consistent contributions.

- Create an emergency fund: Aim to save three to six months’ worth of living expenses in case of unexpected events.

- Start investing: Consider diversifying your savings by investing in stocks, bonds, or real estate, depending on your risk tolerance and financial goals.

Tackling the Components

Once you understand the framework of the 50/30/20 budgeting rule, you can proceed with devising a plan to follow it that works for your budget and lifestyle. The following are some tips to help you create that strategy.

- Assess your needs: Review your fixed and variable expenses to determine which items are essential. Differentiate between wants and needs and find ways to optimize your spending.

- Prioritize debt repayment: Focus on paying off high-interest debt first, such as credit cards or personal loans. Make extra payments whenever possible to reduce interest costs and become debt-free faster.

- Allocate to your wants wisely: Set clear spending limits for each discretionary category. Prioritize experiences that bring you joy and consider cutting back on areas where you tend to overspend.

- Build a solid savings plan: Start by creating an emergency fund and then gradually increase your savings contributions. Explore different investment options to grow your wealth over time.

- Monitor and adjust: Regularly review your spending habits, financial goals, and progress. Make necessary adjustments to ensure you stay on track and continue to make meaningful progress towards your objectives.

The 50/30/20 rule provides a practical framework for managing your finances. It enables you to prioritize essential needs, while balancing the ability to wisely enjoy your hard-earned money, while allocating to your savings goals for the future. Whether you’re in need of a fresh approach to managing your personal and household budget or want to see how your current plan stacks up, give this simple plan a try.

CashFlow Connect Business Online Banking Demo

CashFlow Connect Business Online Banking Demo